CBL,GNC, NSG, and Audit Bureau agree on credit letters to alleviate liquidity crisis

The Central Bank of Libya announced Wednesday the start of issuing letters of credit and bank bonds for those who would like to import commodities and medicines to end the current liquidity crisis.

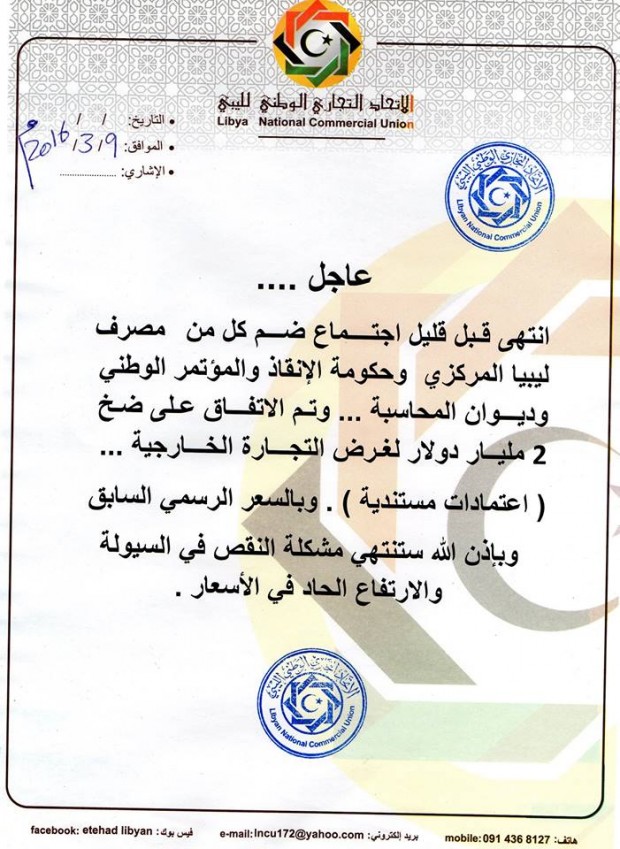

In a joint meeting between the Governor of the CBL, GNC, Audit Bureau and NSG, they all agreed to put forward $2 billion of bank letters of credit by which the dollar would be cashed out at bank rate (LYD1.38) so that the crisis could be alleviated.

Over the last couple of months, Libya has been suffering a very austere cash crisis, people could not even provide the basic needs for their families due to shortage in cash within all banks, which pushed the state institutions to sit together and arrive at a conclusive solution.

How to submit an Op-Ed: Libyan Express accepts opinion articles on a wide range of topics. Submissions may be sent to oped@libyanexpress.com. Please include ‘Op-Ed’ in the subject line.

- CBL devalues dinar by 13.3% against foreign currencies - April 07, 2025

- Libyan teen wins bronze for natural antibiotic discovery - April 07, 2025

- Tunisia begins major migrant camp clearance - April 05, 2025